- Locations we service

Toronto home insurance

Toronto home insurance

Toronto's size and changing weather bring specific challenges for homeowners. Whether you own a downtown condo or a suburban house, properties face seasonal shifts, heavy rain, and the realities of living in Canada's biggest city. For home insurance that helps to protect your investment in the GTA, choose PC® Insurance.

Get a quote

Home insurance Toronto: coverage for life in Canada’s largest city

Home insurance Toronto: coverage for life in Canada’s largest city

Homeownership in Toronto means navigating risks specific to the city. Dense neighbourhoods increase exposure to proximity damage and theft, while aging infrastructure can cause water main breaks and sewer backups. Summer storms bring intense rainfall that overwhelms drainage systems and floods basements across the GTA, while winter freeze-thaw cycles damage foundations and roofs. With Toronto’s high property values, even minor damage can represent substantial financial loss. PC® Insurance offers home insurance that Toronto homeowners trust to help protect one of their most significant financial investments.

3 easy steps to buy home insurance in Toronto.

1

Answer questions about your occupancy type and personal belongings. Then provide some personal details to get an accurate quote.

2

Customize your coverage if needed.

3

Confirm your details and finalize your purchase.

Save with PC® Home Insurance. Get an online quote in minutes.

Get a quoteGet customized coverage in Toronto

Get customized coverage for your home and your stuff. Have questions? Our licensed insurance advisors are here to help.

Basic Coverages

Home

Risks that may be covered include theft, vandalism, wind, lightning, fire, smoke, some water damage, falling objects, explosions and impact by a vehicle.

Personal Property

Home insurance policies cover your personal belongings, like clothing, electronics, appliances and furniture. There are limits on the amount and the types of items that are covered. For example, jewellery, fine art, coin, stamp or card collections and bicycles may require additional coverage.

Personal Liability

This type of coverage can cover damage that you or someone covered by your insurance policy is responsible for causing to someone else, including unintentional injuries or accidental damage to their property.

Additional Living Expenses

Should something happen to your home due to a covered claim and it becomes unlivable, then your additional living expenses, like hotel accommodations, can be reimbursed up to your coverage amount.

Optional Coverages

Sewer Backup

Overland Water

Earthquake

Cyber Insurance

How can I lower my home insurance cost in Toronto?

Home insurance premiums in Toronto are determined by many factors. Here are some possible discounts that may be available when getting an insurance quote.

Discount options, eligibility criteria, and availability vary by province and territory.

Save with PC® Home Insurance. Get an online quote in minutes.

Get a quoteFAQs

Home insurance can help protect against loss or damage of your home and its contents due to unexpected events like fire, smoke, wind, theft and vandalism, and certain types of water damage.

It could also help cover your additional living expenses, such as a hotel or rental unit and meals, up to your coverage amount if you're temporarily unable to live in your home while it’s being repaired due to a covered claim.

Typically, you would buy home insurance before the closing date on your new home, to ensure that you have coverage on your property from the date that you take ownership.

In most cases, a financial institution won’t give you a mortgage or secured line of credit until your home is insured. Make sure to ask questions about your home insurance needs with a PC® licensed insurance advisor and your mortgage advisor, financial institution, or financial specialist when you are buying a property.

The amount of coverage should be enough to cover the value of your possessions and the cost to repair or rebuild your home in the event of a covered claim.

To help evaluate your insurance needs, please call a PC® Insurance advisor at 1-877-253-8177.

Yes! You can earn 2x the regular PC Optimum™ points for every dollar spent when paying your insurance premium annually with your President’s Choice® Financial Mastercard®* or PC Money™ Account*.

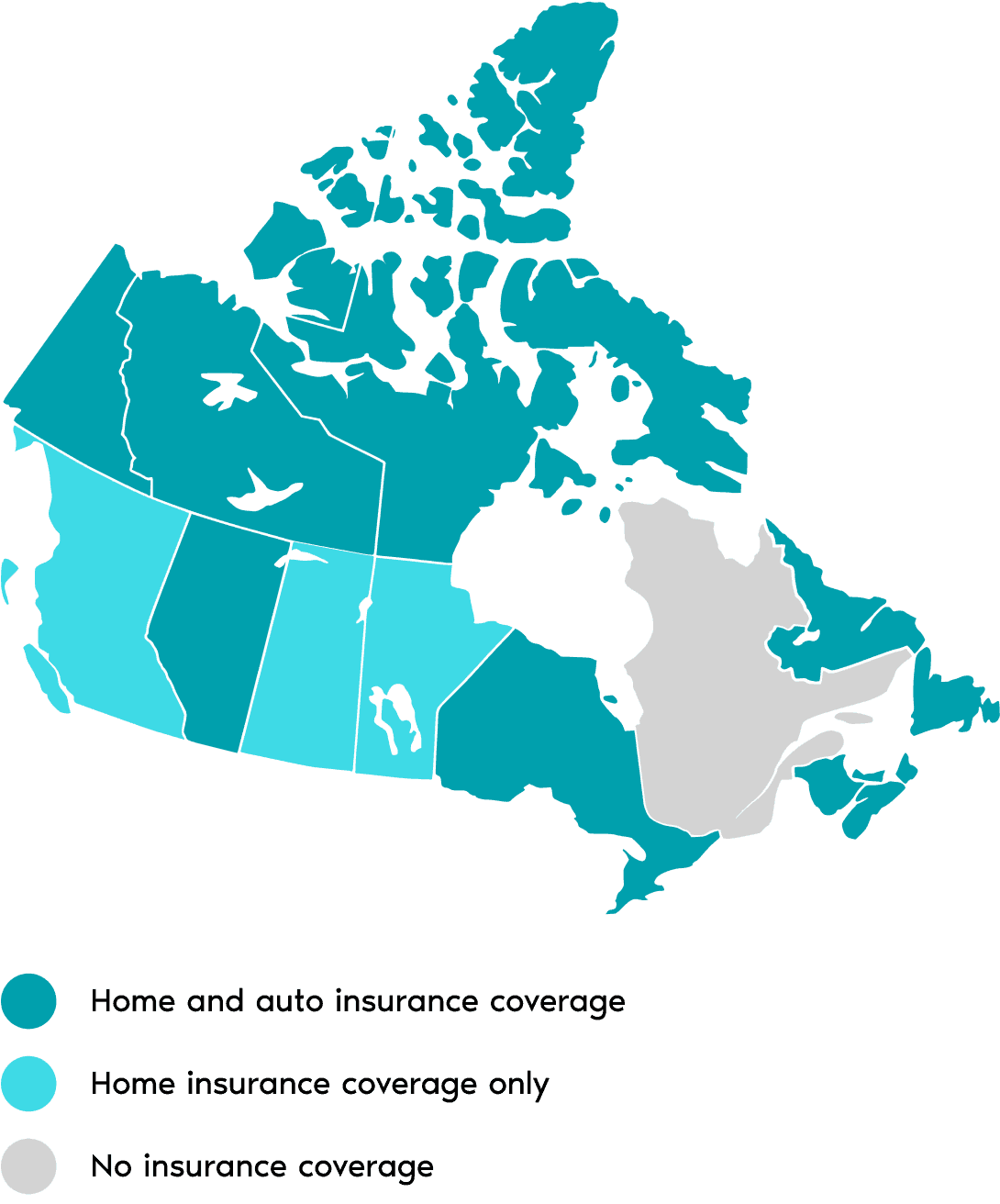

Where we are.

Servicing 12 provinces and territories.

British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Prince Edward Island, Nova Scotia, Newfoundland & Labrador, Yukon, Northwest Territories and Nunavut.

Find your locationLegal details

Important Information on Products, Discounts, and Services by PC Financial Insurance Agency Inc.

Not everyone who uses online platforms or calls in will be able to get a quote or buy an insurance policy. This page provides, for information purposes only, a summary of our different insurance products and discounts that may be available to you. If you purchase a product, the terms and conditions of your insurance coverage will be outlined in your insurance policy, which will prevail. Certain conditions, limitations, and exclusions apply. Savings are not guaranteed and vary based on your profile, place of residence, and, where applicable, year, make and model of your vehicles. Rates, discounts, and eligibility rules are subject to change without notice. Please speak to a PC® Insurance advisor to learn more.

*All purchases with the PC Financial® Mastercard® earn a minimum of 10 PC Optimum™ points per dollar and all purchases with the PC Money™ Account earn a minimum of 5 PC Optimum™ points per dollar. When you pay your PC® Insurance home or auto insurance premium with your PC Financial® card, earn double the regular PC Optimum™ points per dollar (20 points per dollar for PC Financial® Mastercard® and 10 points per dollar for PC Money™ Account). PC Optimum™ points are awarded exclusively by President’s Choice Services Inc. This is not an offer provided by any other entity. PC Money™ Account points offer is available only with Aviva General Insurance Company policies entered into after January 20, 2025. Minimum redemption is 10,000 PC Optimum™ points (worth $10 in free rewards) and in increments of 10,000 PC Optimum™ points thereafter, at participating stores. You can redeem the PC Optimum™ points you earn for eligible purchases, or for any other purposes of which we may advise you from time to time. Some redemption restrictions apply; visit pcoptimum.ca for details and full store list.

†Details on Potential Savings

Save up to $890 on PC® Home and Auto Insurance

PC Optimum™ members could have a combined savings of up to $890 on their homeowner’s and car insurance policies if they are eligible for the following discounts: Combined Policy Discounts by purchasing home and auto insurance together, Claims Free Discount for homeowners, Conviction Free Discount, and Affinity Discount for PC Optimum™ members. Customers may be eligible for other discounts on their car or home insurance such as the Electric Vehicle Discount, Hybrid Vehicle Discount, Winter Tire Discount, Mortgage Free Discount and Multi Product Discount. Savings are based on rates in force as of July 2025. Savings are calculated by determining the average base premium PC® Insurance customers with one car insurance policy and one homeowner insurance policy would have paid if they were not eligible for the discounts. Discounts may not apply to all coverages and endorsements. PC Optimum™ members must be in good standing to be eligible for the Affinity Discount. Certain conditions, limitations, and exclusions apply. Condominium and tenant insurance policies are excluded from this savings calculation. For detailed information about how savings could apply to you, including saving opportunities for condominium owners and tenants, speak with a PC® Insurance advisor.

Save up to $1,000 on PC® Home and Auto Insurance in Toronto

PC Optimum™ members in Toronto could have a combined savings of up to $1,000 on their homeowner’s and car insurance policies if they are eligible for the following discounts: Combined Policy Discounts by purchasing home and auto insurance together, Claims Free Discount for homeowners, Conviction Free Discount, and Affinity Discount for PC Optimum™ members. Customers may be eligible for other discounts on their car or home insurance such as the Electric Vehicle Discount, Hybrid Vehicle Discount, Winter Tire Discount, Mortgage Free Discount and Multi Product Discount. Savings are based on rates in force as of July 2025. Savings are calculated by determining the average base premium PC® Insurance customers with one car insurance policy and one homeowner insurance policy would have paid if they were not eligible for the discounts. Discounts may not apply to all coverages and endorsements. PC Optimum™ members must be in good standing to be eligible for the Affinity Discount. Certain conditions, limitations, and exclusions apply. Condominium and tenant insurance policies are excluded from this savings calculation. For detailed information about how savings could apply to you, including saving opportunities for condominium owners and tenants, speak with a PC® Insurance advisor.

Save up to $150 on PC® Homeowner’s Insurance in British Columbia, Saskatchewan and Manitoba

PC Optimum™ members could save up to $150 on their primary homeowner’s insurance policy if they are eligible for the following discounts: Claims Free Discount for homeowners and Affinity Discount for PC Optimum™ members. In British Columbia, savings for being claims-free have already been factored into the premium rating calculations for homeowner’s policies. Customers may be eligible for other discounts on their homeowner’s insurance such as the Mortgage Free Discount and Multi Product Discount. Savings are based on rates in force as of July 2025. Savings are calculated by determining the average base premium PC® Insurance customers with a homeowner insurance policy would have paid if they were not eligible for the discounts. Discounts may not apply to all coverages and endorsements. PC Optimum™ members must be in good standing to be eligible for the Affinity Discount. Certain conditions, limitations, and exclusions apply. Condominium and tenant insurance policies are excluded from this savings calculation. For detailed information about how savings could apply to you, including saving opportunities for condominium owners and tenants, speak with a PC® Insurance advisor.

Save up to 35% on PC® Home and Auto Insurance

PC Optimum™ members could save up to 35% on their homeowner’s, condominium, or tenant insurance policy if they are eligible for the following discounts: Claims Free Discount, Combined Policy Discount by purchasing home and auto insurance together, and Affinity Discount for PC Optimum™ members. PC Optimum™ members may also save up to 35% on their car insurance policies if they are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount by purchasing auto and home insurance together, and Affinity Discount for PC Optimum™ members. Customers may be eligible for other discounts on their car or home insurance such as the Electric Vehicle Discount, Hybrid Vehicle Discount, Winter Tire Discount, Mortgage Free Discount and Multi Product Discount. Total available discounts are in comparison to the base premium PC® Insurance customers would have paid if they were not eligible for the discounts. Discounts may not apply to all coverages and endorsements. PC Optimum™ members must be in good standing to be eligible for the Affinity Discount. Certain conditions, limitations, and exclusions apply. For further information, see More Information Section below.

Affinity Discount for PC Optimum™ Members

PC Optimum™ members in good standing could benefit from an Affinity Discount on their homeowner’s, condominium, and tenant insurance in all provinces and territories, except Quebec where PC® Insurance is not available. Additionally, an Affinity Discount could apply on car insurance for PC Optimum™ members in the following provinces and territories: Alberta, Ontario, Nova Scotia, Prince Edward Island, Yukon, Northwest Territories, and Nunavut.

Save up to 25% on PC® Motorcycle Insurance

You could save up to 25% on your motorcycle insurance when combining the following discounts: Loyalty, Conviction Free, Motorcycle and Car, Motorcycle and Property, and Multi-Motorcycle. Discounts may not apply to all coverages and endorsements. Due to provincial legislation, PC® Insurance motorcycle products are not offered in British Columbia, Manitoba, and Saskatchewan. Savings are not guaranteed and vary based on your profile and place of residence. Rates, discounts, and eligibility rules are subject to change without notice. If you purchase a product, the terms and conditions of your insurance coverage will be outlined in your insurance policy, which will prevail. Certain conditions, limitations, and exclusions apply.

More Information Section

British Columbia

You can save up to 5% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the Affinity Discount for PC Optimum™ members. In British Columbia, savings for being claims-free have already been factored into the premium rating calculations for homeowner’s, condominium, and tenant insurance policies.

Alberta

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 20% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Saskatchewan

You can save up to 20% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the Claims Free Discount and Affinity Discount for PC Optimum™ members.

Manitoba

You can save up to 20% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the Claims Free Discount and Affinity Discount for PC Optimum™ members.

Ontario

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 25% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

New Brunswick

You can save up to 35% on car insurance if you are eligible for the following discounts: Conviction Free Discount and Combined Policy Discount. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Nova Scotia

You can save up to 40% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Prince Edward Island

You can save up to 35% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Newfoundland and Labrador

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount and Combined Policy Discount. You could also save up to 35% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Northwest Territories, Yukon, and Nunavut

You can save up to 15% on car insurance if you are eligible for the Combined Policy Discount and Affinity Discount for PC Optimum™ members. You could also save up to 35% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.