- Locations we service

Ontario auto insurance

Auto insurance in Ontario made easy.

Whether you’re running errands in Toronto or commuting to work in Ottawa, we’ve got you covered. PC Optimum™ members can save up to 35%† when they bundle their home and auto insurance and are eligible for other available discounts.

Get a quote

Why is car insurance important in Ontario?

Why is car insurance important in Ontario?

If you drive a vehicle in Ontario, you must have coverage – it’s the law.

Even the safest drivers can get into accidents.

It helps to cover the cost of repairs or to replace a vehicle.

3 easy steps to buy your auto insurance in Ontario.

1

Answer questions about your vehicle details, licence, and driving history to get an accurate quote.

2

Customize your coverage if needed.

3

Provide your licence number, vehicle ID number, and payment details to complete your purchase.

Save with PC® Auto Insurance. Get an online quote in minutes.

Get a quoteWhich car insurance coverages are required in Ontario?

To legally drive a vehicle in Ontario, there are certain mandatory coverages that your auto insurance policy must include. These are the four types of auto insurance coverage that are required in Ontario.

Mandatory Coverage

Liability

This coverage will help cover costs up to the amount you’ve chosen if you’re found responsible for a collision or accident that causes harm to someone and/or their property and are sued.

Accident Benefits

If you’re injured in an accident - regardless of who’s at fault - you can be covered for some medical expenses and a portion of lost income.

Direct Compensation Property Damage

Your claim is paid out directly to you by your insurance company, rather than a third party, if your vehicle is damaged in a covered accident where the other motorist is at fault. In some provinces, you can opt out of this coverage.

Uninsured Automobile

Provides coverage if you or your family are hurt or killed by a driver without insurance or in a hit-and-run accident. When you aren’t at-fault, it also covers damage to your car and its contents caused by an identified uninsured driver.

Optional Coverage

These are some optional coverages that may be available.

Comprehensive

Collision or Upset

Conviction Protector

Waiver of Depreciation

Family Protection

Accident Rating Waiver

Liability for Damage to Non-Owned Cars

How can I lower my auto insurance cost in Ontario?

While having car insurance is mandatory in Ontario, there are ways you can help reduce your car insurance costs. Auto insurance rates are largely determined based on the risks to insure the driver and the vehicle. Taking advantage of available discounts can help lower your rates.

Discount options, eligibility criteria, and availability vary by province and territory.

Save with PC® Auto Insurance. Get an online quote in minutes.

Get a quoteFAQs

In Canada, it is illegal to drive without automobile insurance.

You must be insured for:

Liability

This coverage will help cover costs up to the coverage amount you’ve chosen if you’re found responsible for a collision or accident that causes harm to someone and/or their property and are sued.Accident Benefits

If you’re injured in an accident — regardless of who’s at fault — you can be covered for some medical expenses and a portion of lost income.Direct Compensation Property Damage

Your claim is paid out directly to you by your insurance company, rather than a third party, if your vehicle is damaged in a covered accident where the other motorist is at fault. In some provinces, you can opt out of this coverage.Uninsured Automobile

Provides coverage if you or your family are hurt or killed by a driver without insurance or in a hit-and-run accident. When you are not at fault, it also covers damage to your vehicle and its contents caused by an identified uninsured driver.

Yes, as long as they have a valid licence and you give them permission to drive the vehicle. All licensed drivers in your home must be listed on your policy, no matter how often they drive your vehicle.

PC Optimum™ points are awarded when your insurance premium is paid annually with your PC® Mastercard®* or PC Money™ Account* and should show up in your PC Optimum™ account within a few days.

You can check the status of your points in your online account or by using the PC Optimum™ app.

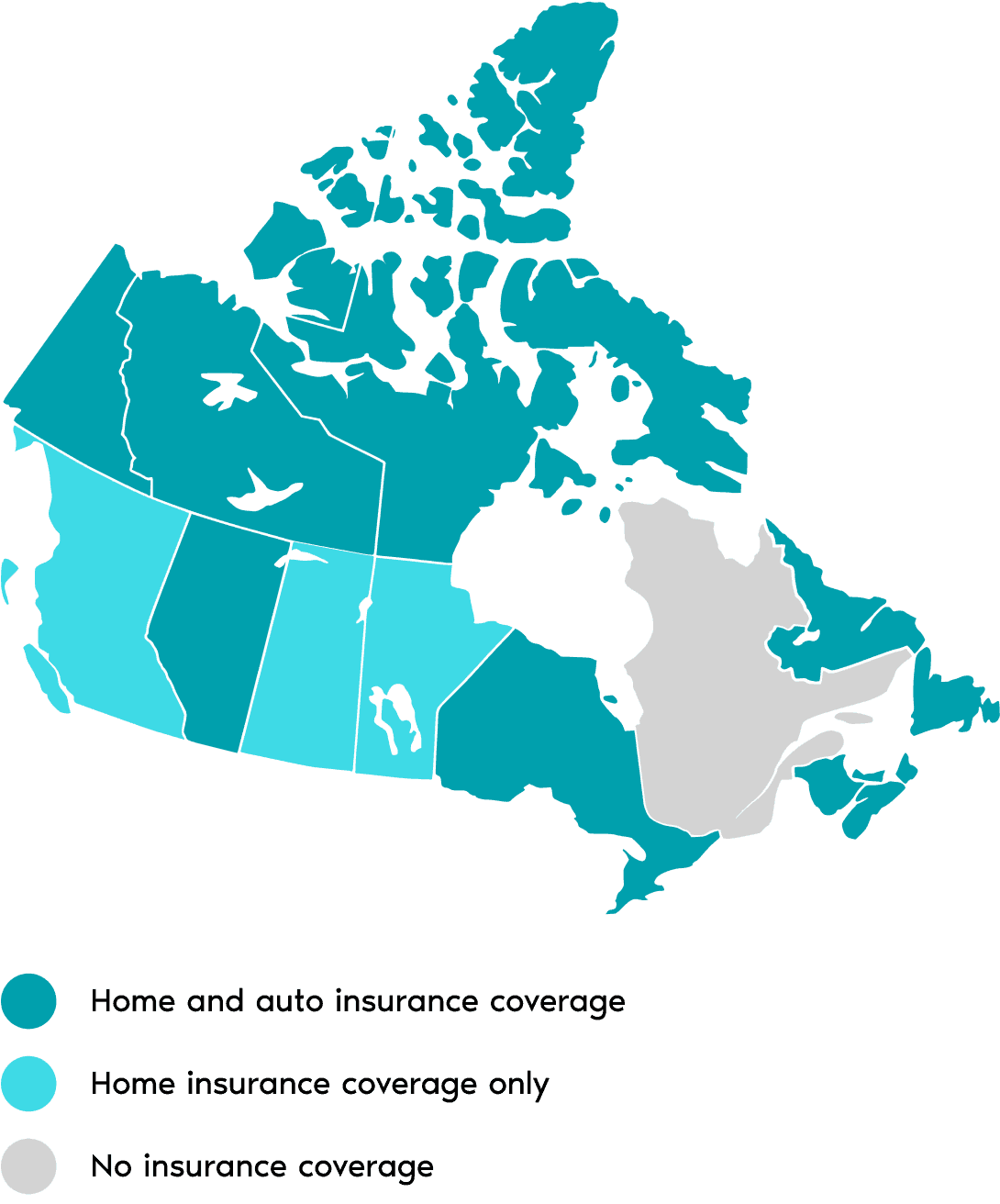

Where we are.

Servicing 12 provinces and territories.

British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Prince Edward Island, Nova Scotia, Newfoundland & Labrador, Yukon, Northwest Territories and Nunavut.

Find your locationLegal details

Important Information on Products, Discounts, and Services by PC Financial Insurance Agency Inc.

Not everyone who uses online platforms or calls in will be able to get a quote or buy an insurance policy. This page provides, for information purposes only, a summary of our different insurance products and discounts that may be available to you. If you purchase a product, the terms and conditions of your insurance coverage will be outlined in your insurance policy, which will prevail. Certain conditions, limitations, and exclusions apply. Savings are not guaranteed and vary based on your profile and place of residence. Rates, discounts, and eligibility rules are subject to change without notice. Please speak to a PC® Insurance agent to learn more.

*All purchases with the PC Financial® Mastercard® earn a minimum of 10 PC Optimum™ points per dollar and all purchases with the PC Money™ Account earn a minimum of 5 PC Optimum™ points per dollar. When you pay your PC® Insurance home or auto insurance premium with your PC Financial® card, earn double the regular PC Optimum™ points per dollar (20 points per dollar for PC Financial® Mastercard® and 10 points per dollar for PC Money™ Account). PC Optimum™ points are awarded exclusively by President’s Choice Services Inc. This is not an offer provided by any other entity. PC Money™ Account points offer is available only with Aviva General Insurance Company policies entered into after January 20, 2025. Minimum redemption is 10,000 PC Optimum™ points (worth $10 in free rewards) and in increments of 10,000 PC Optimum™ points thereafter, at participating stores where President's Choice® products are sold. Some redemption restrictions apply; visit pcoptimum.ca for details and full store list.

†Details on Potential Savings

Save up to 35% on PC® Home and Auto Insurance

PC Optimum™ members could save up to 35% on their homeowner’s, condominium, or tenant insurance policy if they are eligible for the following discounts: Claims Free Discount, Combined Policy Discount by purchasing your home and auto insurance together, and Affinity Discount for PC Optimum™ members. PC Optimum™ members may also save up to 35% on their car insurance policies if they are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount by purchasing your auto and home insurance together, and Affinity Discount for PC Optimum™ members. Customers may be eligible for other discounts on their car or home insurance such as the Electric Vehicle Discount, Hybrid Vehicle Discount, Winter Tire Discount, Mortgage Free Discount and Multi Product Discount. Total available discounts are in comparison to the base premium you would have paid if you were not eligible for the discounts. Discounts may not apply to all coverages and endorsements. PC Optimum™ members must be in good standing to be eligible for the Affinity Discount. Certain conditions, limitations, and exclusions apply. For further information, see More Information section below.

Affinity Discount for PC Optimum™ Members

PC Optimum™ members in good standing could benefit from an Affinity Discount on their homeowner’s, condominium, and tenant insurance in all provinces and territories, except Quebec where PC® Insurance is not available. Additionally, an Affinity Discount could apply on car insurance for PC Optimum™ members in the following provinces and territories: Alberta, Ontario, Nova Scotia, Prince Edward Island, Yukon, Northwest Territories, and Nunavut.

Save up to 25% on PC® Motorcycle Insurance

You could save up to 25% on your motorcycle insurance when combining the following discounts: Loyalty, Conviction Free, Motorcycle and Car, Motorcycle and Property, and Multi-Motorcycle. Discounts may not apply to all coverages and endorsements. Due to provincial legislation, PC® Insurance motorcycle products are not offered in British Columbia, Manitoba, and Saskatchewan. Savings are not guaranteed and vary based on your profile and place of residence. Rates, discounts, and eligibility rules are subject to change without notice. If you purchase a product, the terms and conditions of your insurance coverage will be outlined in your insurance policy, which will prevail. Certain conditions, limitations, and exclusions apply.

More Information Section

British Columbia

You can save up to 5% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the Affinity Discount for PC Optimum™ members. In British Columbia, savings for being claims-free have already been factored into the premium rating calculations for homeowner’s, condominium, and tenant insurance policies.

Alberta

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 20% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Saskatchewan

You can save up to 20% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the Claims Free Discount and Affinity Discount for PC Optimum™ members.

Manitoba

You can save up to 20% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the Claims Free Discount and Affinity Discount for PC Optimum™ members.

Ontario

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 25% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

New Brunswick

You can save up to 35% on car insurance if you are eligible for the following discounts: Conviction Free Discount and Combined Policy Discount. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Nova Scotia

You can save up to 40% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Prince Edward Island

You can save up to 35% on car insurance if you are eligible for the following discounts: Conviction Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members. You could also save up to 40% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Newfoundland and Labrador

You can save up to 30% on car insurance if you are eligible for the following discounts: Conviction Free Discount and Combined Policy Discount. You could also save up to 35% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.

Northwest Territories, Yukon, and Nunavut

You can save up to 15% on car insurance if you are eligible for the Combined Policy Discount and Affinity Discount for PC Optimum™ members. You could also save up to 35% on your homeowner’s, condominium, or tenant insurance policy if you are eligible for the following discounts: Claims Free Discount, Combined Policy Discount, and Affinity Discount for PC Optimum™ members.